Click through our interactive data analyses

Each data point on a graphic contains further information. Click on each element or hover over it with your mouse. Ah, we are designed especially for tablets. Swipe and Touch!

Hui!

This view makes me feel a bit dizzy ...

Can we please change the format to landscape ?

Data provides information about fees, auditing companies and the people who audit Germany's largest companies.

Each data point on a graphic contains further information. Click on each element or hover over it with your mouse. Ah, we are designed especially for tablets. Swipe and Touch!

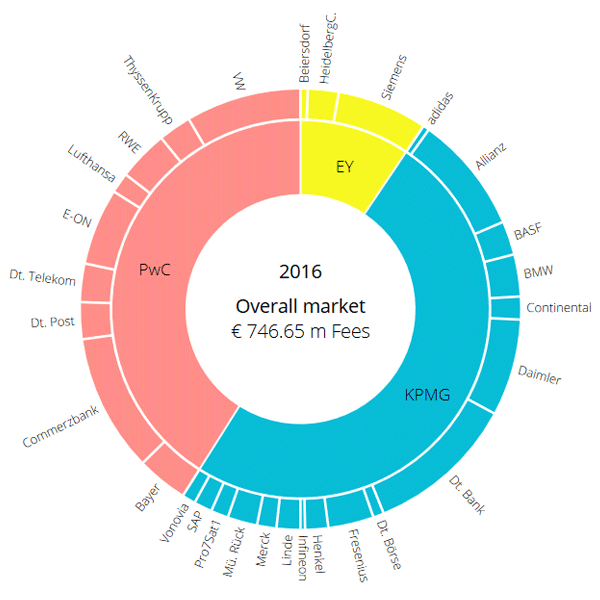

Which auditing company has the biggest slice of the pie?

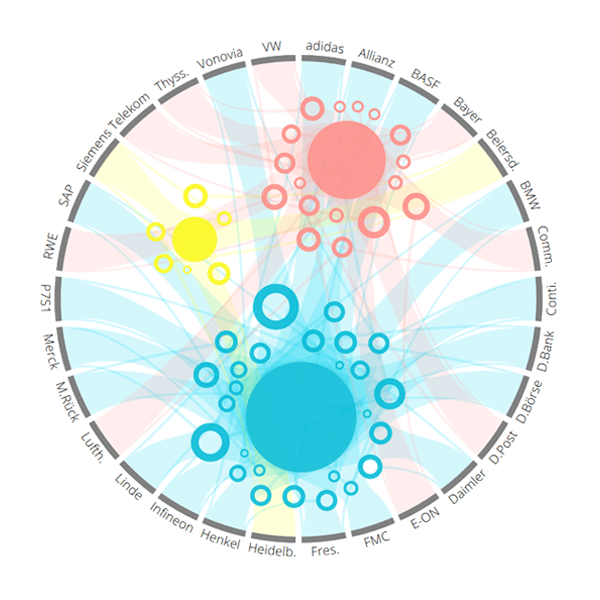

What fees are paid by which companies, and to whom?

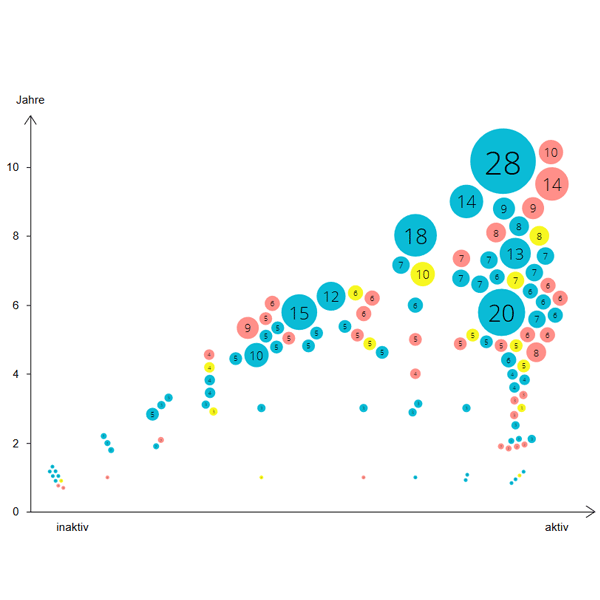

Which auditors perform audits for Dax companies as individuals?

Our analyses are based on companies' 2007-2016 annual reports (DAX 30, 18/03/18). We update the data and expand the analyses.

In the past 10 years in Germany, the market for the prestigious and fee-generating DAX 30 companies has been divided between only three of the so-called "Big Four" auditing companies. Compared to KPMG, EY (Ernst & Young) and PwC (PricewaterhouseCoopers), Deloitte has been under-represented in the German market until now.

However, with the legal provision regarding rotation having recently entered into force, under the terms of which a new mandate must be issued after 10 years, the make-up of the market is set to change. In 2017, Deloitte was able to be part of the action once again by carrying out the audit for Bayer AG.

While traditional reporting covers shifts in positions, this data project delves deeper and allows the user to come to their own conclusions. Interact through the three chapters of this data story. Ask questions of the data, such as:

What auditing fees are actually paid by which companies and how big is the market overall?

Which auditors perform audits for DAX, what experience does the company have, who needs to swap out after 7 years, who can jump in?

What percentage of the overall fee is accounted for by tax services and how much is generated abroad?

We are continuing to update and develop this project. Please share any questions you may have with us.

It is interesting to take a look at the individual professionals, namely the auditors. 4 Facts:

We expand this project and update the data as soon as new data sets are available.

Would you like us to let you know when an update becomes available online?

Updating of data:

You can continue to do that: